A Biased View of Business Owners' Protection (BOP) Insurance - NCMIC

Top Guidelines Of Owners Insurance / Minnesota.gov

They might also have limitations if a main organization home steps over or under a defined location. Generally, businesses classes qualified for BOPs include retail stores, apartment buildings, small dining establishments, and office-based companies.

Business Owners Policy - Insurance Broker - SGB Insurance Services

Industrial Car Insurance coverage This insurance coverage covers vehicles used for organization functions, consisting of: Cars and trucks Pickup trucks Box trucks Service utility trucks Food trucks GEICO does presently use insurance for semi-trucks and tractor-trailers. Why do you need business auto insurance coverage? Individual vehicle insurance coverage does not constantly cover business usage. Without industrial auto insurance coverage, you're at risk of: Having actually restricted or no coverage for accidents Paying of pocket for repairs, injuries, and more Losing your individual auto protection Numerous tasks and agreements require industrial auto insurance, which GEICO can provide.

Business Owner's Policy Insurance Cost - Insureon

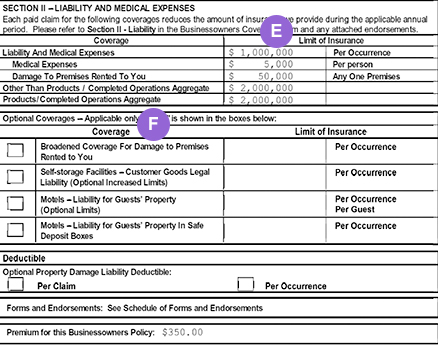

Company owner's Policy, Save money with an insurance coverage package that covers common lawsuits and home damage. What type of work do you do? Get Quotes, We partner with trusted A-rated insurance coverage companies, Company owner's policy, An entrepreneur's policy (BOP) packages general liability insurance coverage with industrial residential or commercial property insurance. It typically costs less than if the policies were purchased independently.

The 9-Minute Rule for Business Owners Policy (BOP) Insurance Services - Vetinsure

Most small companies require general liability insurance coverage and commercial home insurance coverage when they lease or own a workplace or other commercial area. On top of that, customer agreements typically require general liability protection. Even when protection isn't needed, a BOP is a wise option for little organizations that work straight with the general public and own residential or commercial property.

A BOP is particularly created for low-risk small companies. If you qualify, your business saves cash and gains protection for the most typical claims. What does Also Found Here ? An entrepreneur's policy includes both general liability insurance coverage and industrial property insurance coverage, often called organization risk insurance. Together, they offer liability and residential or commercial property coverage for your small company.

It likewise pays legal costs related to marketing injuries, including character assassination and copyright infringement. Organizations that rent commercial space, have a home mortgage, or work with expensive customer residential or commercial property are frequently required to bring this type of protection. Commercial home insuranceCommercial property insurance coverage spends for repair work or replacement of damaged, destroyed, or stolen company home.